From ground to cloud: Will the billions invested in sustainable aviation truly decarbonise the industry?

Why have some startups received far more funding than others?

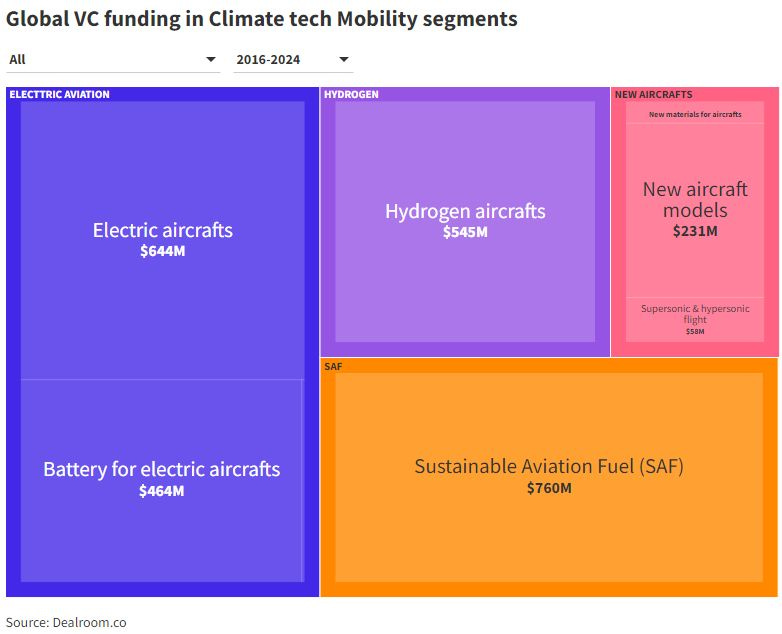

Over $2.7 billion has been pumped into sustainable aviation startups since 2016, according to Dealroom.co, a data platform that provides intelligence on startups and investment strategies.

Interestingly, however, our conversation with Lorenzo Chiavarini, Dealroom's authority on B2B venture capital research, revealed another sum:

About $5-$6 billion has been put into eVTOLs (electric Vertical Take-Off and Landing aircraft) or electric air taxis – almost 2-3x as much as the figure mentioned above.

Dealroom hasn’t included eVTOL investments in the sustainable aviation total since the relatively small payload and flying distance of these aircraft mean they wouldn’t be able to make much of a dent in aviation’s quest for net zero.

Some startups are more equal than others

In effect, these electric air taxis have so far raised over twice as much as electric / hydrogen aircraft startups and new SAF companies combined.

For example, the number of sustainable aviation startups that have raised $100+ million can be counted on one hand. This small group includes:

Swedish hybrid-electric aircraft maker Heart Aerospace, which recently completed a Breakthrough Energy-led funding round;

ZeroAvia, the US/UK hydrogen-electric engine maker;

Flying Whales, which is developing cargo blimps;

Sustainable operator Surf Air, which recently placed an order for Electra’s hybrid-electric nine-seat aircraft.

Meanwhile, Universal Hydrogen, which is developing hydrogen-electric conversion kits for aircraft, is close to the $100 million figure.

That’s it.

At the same time, three times as many eVTOL companies have reached this funding landmark.

This disparity raises critical questions about the effectiveness of current investment strategies. Are resources being allocated to the sectors with the highest potential impact, or is there an overemphasis on what some critics, like Michael Barnard, deride as "origami electric helicopters" and a “VC-funded bad idea”?

After all, developing a new electric or hydrogen aircraft is extremely capital-intensive. When researching our book, Sustainability in the Air, the figure most often quoted to us was $1 billion.

Chiavarini suggests this is, if anything, an underestimate. He points to the Dutch hybrid-electric startup Elysian's projection of needing more than $5 billion to begin commercial production of its 90-seat aircraft by 2033.

Can the funding gap be overcome?

The broader climate tech sector as a whole has witnessed investment growth, capturing over a quarter of all venture capital in 2022, as documented by PwC.

Even so, as the European VC entity World Fund has indicated, there’s still a substantial funding shortfall, with only 16% of climate finance needs currently being met.

Chiavarini echoed this sentiment, identifying a significant funding gap in climate technology needs:

Broadly speaking, there will be an annual investment necessity of six to eight trillion dollars to meet global net zero demands.

However, he also pointed to the “tens of billions” in VC reserves, or ‘dry powder’ poised for allocation, with the potential for amplification through public and state investment contributions.

Addressing the critical "Valley of Death" faced by startups after exhausting initial funding rounds, Chiavarini highlighted the necessity for substantial capital and patient investors to transition from conceptual designs to working prototypes. He stated this often comes at around the $30 million Series B funding stage.

Fortunately, several investors are willing to make long-term (7-10 year) bets with entities like Breakthrough Energy and Saudi Arabia’s NEOM Investment Fund, which are currently bridging this gap.

In a recent article, we looked at why some startups succeed and others fail. Chiavarini echoed many of our findings, saying that success hinges on a well-articulated business strategy and a robust pre-order portfolio, even if these are primarily based on letters of intent without immediate cash commitments. Furthermore, the compelling narratives of the founders also play a crucial role in securing investment.