How Honda plans to outlast the eVTOL hype

While rivals race to launch all-electric air taxis, the Japanese manufacturing giant is betting its hybrid powertrain, certification experience, and manufacturing muscle will win the long game.

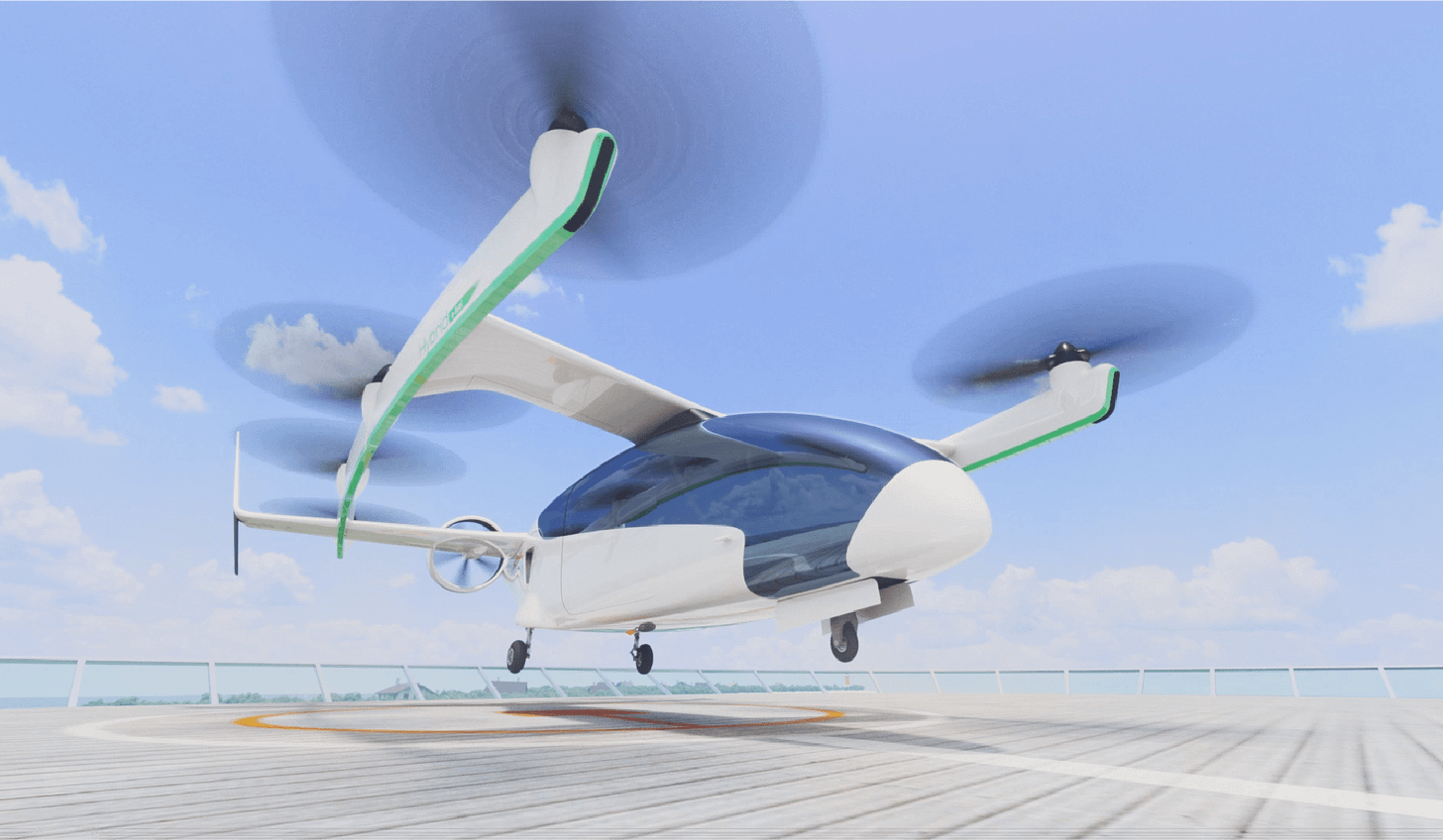

Japanese manufacturing giant Honda is taking a contrarian path in the advanced air mobility (AAM) market, betting that hybrid-electric propulsion and manufacturing scale will trump the pure-electric strategies of rivals rushing to commercialise flying taxis.

At Dubai Airshow 2025, Honda’s eVTOL chief, Hirohide Azuma, laid out a timeline that won’t see commercial operations until the early 2030s, years after current market leaders Joby Aviation and Archer Aviation plan to launch their services.

According to Azuma, the delay is deliberate. “Joby and Archer are ahead of us, and I admit that they are moving forward,” Azuma said in an interview with Sustainability in the Air.

But while competitors chase headlines with ambitious timelines, Honda is playing a different game.

The hybrid gambit

Honda’s break from industry orthodoxy centres on propulsion. While Joby, Archer, and companies like the UK’s Vertical Aerospace pursue all-electric designs with ranges of roughly 100-200 kilometres, Honda’s gas turbine hybrid system delivers a range of 400 kilometres. That makes Honda’s electric air taxi a possibility for connecting cities, and not just to ferry passengers from Manhattan to JFK.

“Battery cannot provide enough energy capacity,” Azuma stated. The hybrid system solves another critical problem: reserve power. “After the system failure, EV should have a reserve energy. So, it’s a very short reserve of energy.”

As a result, Honda’s electric air taxi will be able to carry four passengers plus luggage over inter-city distances, while many other competitors must choose between payload and range.

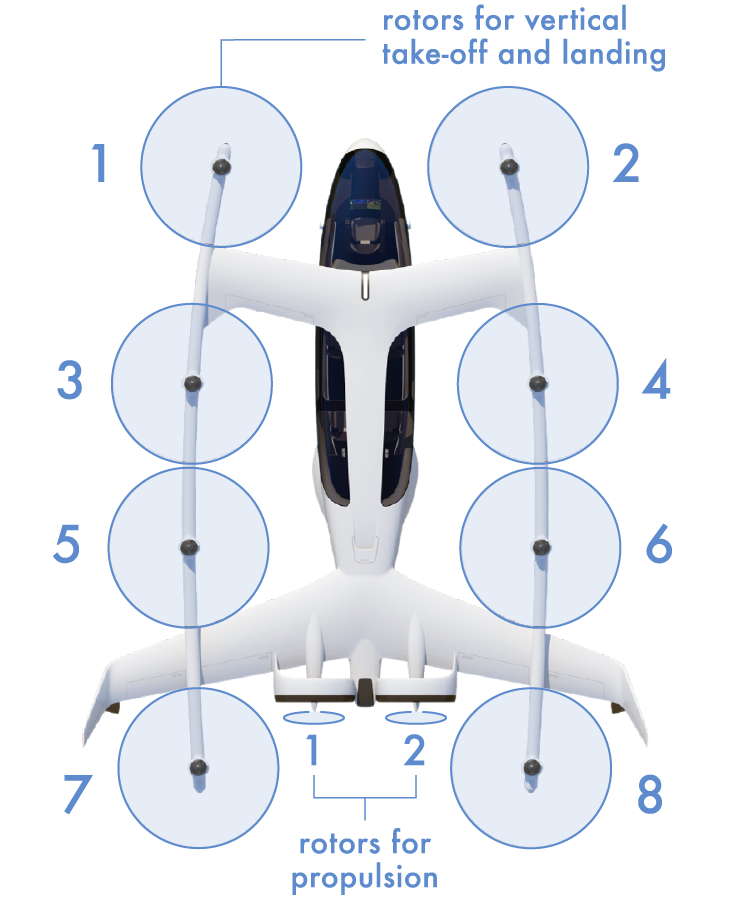

In terms of design, Honda has taken a safety-first approach. A tiltrotor, an aircraft that changes the angle of its rotors to generate both lift and thrust, has an advantage in terms of fuel efficiency.

However, Honda says that in the case of a malfunction, the integration of the lift/thrust functions may lead to multiple critical function losses. To address this safety concern, Honda eVTOL is equipped with eight rotors for vertical take-off and landing and two rotors for propulsion, ensuring a high degree of redundancy by distributing functions.

This not only ensures safety but also enables smaller rotor diameters, resulting in ultra-quiet operations. In addition to ensuring passenger comfort, the quietness of eVTOL will minimise the impact on the surrounding environment during take-off, landing, and in-flight.

The certification card

Honda holds an important ace — the experience of producing HondaJet, which claims to be the ‘world’s most advanced light jet’.

Since 2015, Honda Aircraft Company has navigated FAA certification, established U.S. manufacturing, and built relationships with regulators.

“We have a certification capability for the HondaJet,” Azuma noted. By comparison, most competitors in the eVTOL space “have not prepared that capability for now.”

This translates to potentially faster, cheaper certification with fewer hiccups. While startups run the risk of burning capital learning aerospace regulations, Honda already speaks the language.

Azuma told us that the company will leverage its North Carolina manufacturing facilities and FAA relationships to certify first in the U.S., then expand to Europe and Asia.

Why Honda is the dark horse to watch

Here are four reasons why Honda could disrupt the eVTOL sector’s current narrative:

Capital is key: Building a new aircraft requires billions in capital. Joby has raised $2 billion and still needs more. Honda can fund its entire eVTOL program from operating cash flow. If Honda wants an aircraft programme, it will simply build one — no roadshows, no dilution, no quarterly investor calls demanding faster timelines.

The HondaJet dividend: Certification isn’t just paperwork but is a consequence of years of building relationships with regulators, understanding aerospace quality systems, and hard-won knowledge of what kills aircraft programmes.

Hybrid’s hidden logic: Purists championing all-electric flight may be solving the wrong problem. Instead of short-hop air taxis, the real money may well be in 200-400 kilometre routes between cities, distances that batteries can’t economically serve for now.

Honda’s hybrid systems bet that the market is bigger than just urban transport. So when Azuma told us they’ll switch to pure electric “if the battery technologies make a good technological progress,” he’s keeping options open while solving today’s actual use cases.

Manufacturing muscle matters: The eVTOL industry talks a lot about software and autonomy, but someone still needs to build thousands of aircraft cheaply and reliably at automotive scale. Honda manufactures millions of motorcycles, cars, and power products annually. They understand supply chains, quality control, and the economics of mass production. When this industry shifts from prototypes to products, manufacturing excellence will likely determine winners.

The bottom line? If you believe batteries will improve slowly, infrastructure will take time, and certification will prove a challenge, then Honda’s strategy looks prescient.