The latest airline to adhere to science-based net zero targets (via SBTi) is JetBlue. This comes after easyJet released its accelerated net zero timetable in October.

Let’s look at what JetBlue is proposing to do, and contrast that with easyJet’s plan.

Applying to SBTi first of all involves committing to a near-term target, as well as a 2050 net zero one.

That’s sensible as it prevents organisations from releasing figures for 28 years in the future, that they may or may not meet.

As a result, JetBlue intends to achieve a 50% greenhouse gas reduction per revenue tonne kilometre (RTK) by 2035 from a 2019 base year. Per-seat emissions will therefore be cut in half in just over a decade.

Note that JetBlue is one of a handful of airlines that has made a 2040, and not a 2050 net zero commitment.

By 2050 JetBlue intends for the largest share of its net zero mix (51%) to comprise of Sustainable Aviation Fuel.

Here, the airline has been actively signing agreements with SAF manufacturers

Recently, JetBlue inked a deal with Air Company for a supply of the Brooklyn start-up’s SAF made from CO2. And just this week, the airline announced a deal with Fidelis for the supply of 92 million gallons of SAF.

The next biggest share (26%) comes from what JetBlue calls next-generation aircraft. The airline seems to mean more fuel-efficient aircraft resulting from the retirement of the E190s in the fleet, as opposed to hydrogen or electric-powered planes.

Under Science Based targets it is possible to have a small amount (<10%) of the net zero pie coming from carbon offsets. JetBlue has allocated 5% and in its media statement says that it continues to believe in high-quality offsetting.

However, the airline has elected to not continue the voluntary carbon offsetting of domestic flights into 2023.

Instead, JetBlue says that “it will reallocate its offsetting spending into operational investments that align with its science-based target, as well as evolve its offsetting strategy to support a curated list of primarily nature-based projects in and around the destinations the airline serves.”

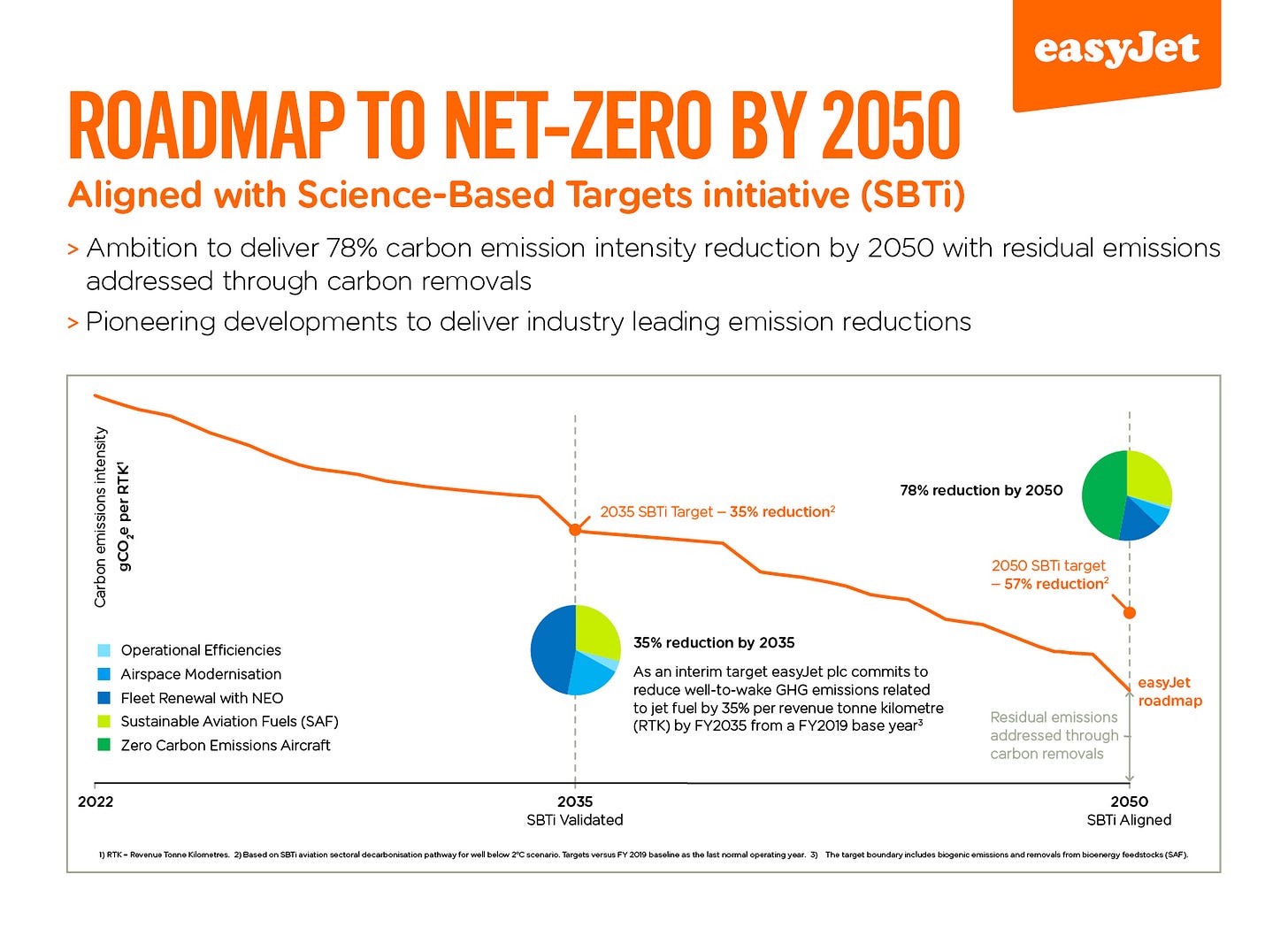

European LCC easyJet meanwhile published a very different road map to JetBlue.

Like JetBlue, easyJet will no longer offset flights. However, it has elected to abandon carbon offsetting altogether and is instead looking at carbon capture via Canada’s Carbon Engineering.

By 2035, easyJet is aiming for a 35% reduction in “well to wake” (total lifecycle) greenhouse gas emissions per RTK related to a 2019 baseline, so a less ambitious target compared to JetBlue.

By 2050, the airline then aims for an 87% reduction. Unlike JetBlue, the biggest share of that will be via next-generation aircraft.

In particular, the airline is betting on hydrogen technology maturing and is working with Rolls Royce (which recently announced a successful engine test) on H2 development.

The next biggest share comes from SAF, and then from a fleet modernisation programme, in particular involving the A321neo.

The remaining emissions will be dealt with via the carbon capture projects that the airline is looking into.

Though the two airlines offer very different-looking road maps, they have one thing in common.

Reaching net zero via science-based targets isn’t possible through more fuel-efficient aircraft and schemes such as CORSIA alone.

Both are counting on most of their emissions reductions coming from non-fossil fuel-powered aircraft, whether that’s through SAF or from new technologies such as Hydrogen.

Deal news

Virgin Atlantic Plans To Purchase 70 Million Gallons Of US Sustainable Fuel (Simple Flying)

Other sustainable aviation news

Envest Global & CAPA Release Airline Sustainability Ratings (Business Travel News)

IAG sustainability chief warns of industry expertise shortage (Flight Global)

Corporate travel propels boom in sustainable aviation fuel (Reuters)

Etihad Airways ends the year with two prestigious sustainability awards (ARGS)

Ryanair to buy sustainable fuel from Shell but 2030 target elusive (Reuters)