Welcome to Season 2 of Sustainability in the Air, the world’s first podcast dedicated to sustainable aviation. Through in depth conversations with top aviation leaders, we break through the clutter and provide a clear roadmap for a net-zero future.

Directly or indirectly, travel accounts for a staggering 10% of global GDP. Of this, however, business travel is the most important and lucrative. Consider this: while business travellers comprise about 25% of the passengers on any given flight, they can constitute up to 50% of revenues or 75% of profits on certain routes. Consequently, any conversation about sustainable travel would, by default, centre around the business traveller.

In this episode of our ‘Sustainability in the Air’ podcast, Nora Lovell Marchant, Vice President of Global Sustainability at American Express Global Business Travel (Amex GBT), speaks with SimpliFlying CEO, Shashank Nigam and discusses how the company is preparing for a net zero future through various initiatives such as a blockchain-powered Sustainable Aviation Fuel (SAF) platform, an independently verified carbon offsetting programme and more.

You can listen and subscribe to our podcast below or read our deep-dive into the episode.

If you’re rushed for time, you can also directly jump to your topic of interest by referring to these time-stamps:

On the business travel sector and its impact (3:26)

Building a blockchain-based SAF platform (5:19)

Frequent flyer tax, demand management and carbon pricing (10:26)

How to make business travel more sustainable (16:47)

Personal accountability and big picture thinking (19:10)

On supersonic travel’s viable path to sustainability (20:15)

The mitigation hierarchy and how to think about carbon offsets (25:06)

What will business travel look like in 2030? (30:21)

What does success look like? (34:37)

Why SAF is currently the best shot at net zero (36:50)

Rapid fire! (39:38)

Building a blockchain-based SAF platform

Amex GBT is the world’s leading business partner for managed travel. The company’s travel professionals are available in more than 140 countries to provide travel management services, organise meetings and events, and deliver business travel consulting.

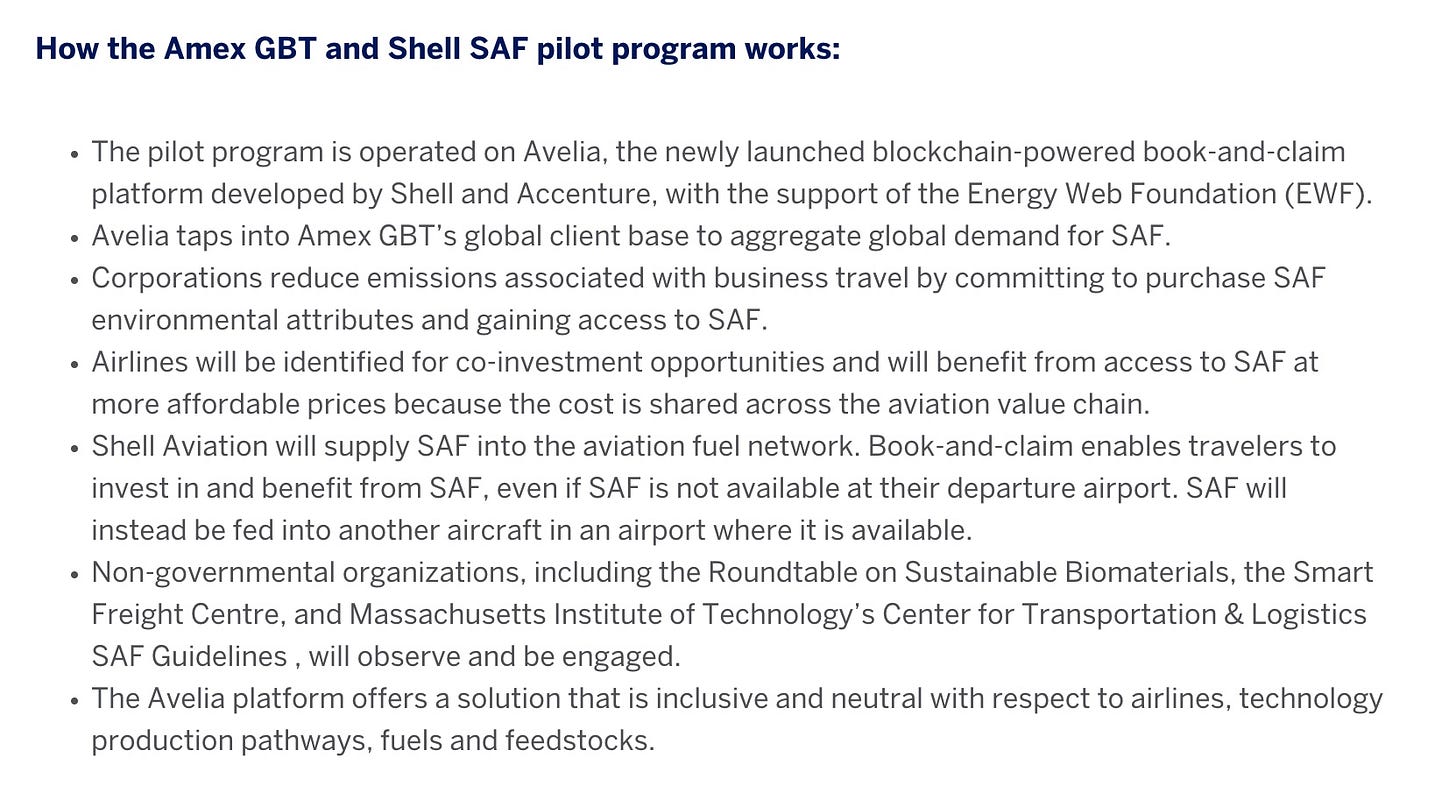

Amex GBT believes that in order to decarbonise travel, and aviation in particular, sustainable aviation fuel (SAF) presents the biggest opportunity. To help accelerate the development of SAF markets, they have partnered with Shell to launch a SAF pilot program, and the world’s first blockchain-powered platform called Avelia. Avelia is a digital SAF book-and-claim solution for business travel.

Under the program, SAF will be certified in line with the regulatory standards set within the country of delivery. Moreover, purchase commitments by Accenture, Amex GBT, Aon and Shell, are all expected to support market development and drive investment to accelerate global supply. Aon is the first customer to join the program. Amex GBT is also in talks with several other global and multinational customers and airlines.

Image Source: Amex GBT

Carbon offsetting and the mitigation hierarchy

Marchant says she knows that offsets are a controversial route to net zero. However, she proposes a holistic view of the challenge through the mitigation hierarchy: Reduce what you can, offset what you can’t – a trademarked phrase from carbonfund.org.

One of the key challenges that Marchant faces is that many customers are wary of carbon offsets and don’t invest in them. However, that works if the budget is being used for carbon reduction projects. But if neither reduction nor offsets are being done, the end result is effectively zero. The industry, Marchant believes, has no choice but to move forward with the available tools and technologies at its disposal, and continue to invest in high quality, high integrity offsets is one of those.

While admitting that she enjoyed John Oliver’s television segment on offsetsrecently, Marchant says that not all of it was true and it’s incumbent upon all of us to spread the truth – that all carbon offsets are not created equal. For example, she says if you’re spending $2 on a carbon offset that’s probably not changing anything. She suggests the solution is to collectively challenge the status quo. And that means investing in carbon offsets that are worthwhile.

Amex GBT is, in fact, putting their money where their mouth is. Earlier in 2022, the company announced that GBT customers can purchase carbon offsets on preferred terms from leading non-profit organizations: Carbonfund.org Foundation and Carbon Footprint. Companies can choose which offset activity they wish to support from a variety of project types, price points, and locations worldwide. Amex GBT says each available project is independently verified and validated.

While Marchant firmly believes that carbon offsets are a good start, she insists that one should never lose sight of the mitigation hierarchy. Further, she wants everyone to start thinking beyond carbon markets and take a more holistic ecosystem services view.

For Marchant, carbon markets are mechanisms for protecting biodiversity. These mechanisms require investing in nature-based solutions, reducing the emissions from deforestation and degradation. She insists that carbon markets – when done right – are a financing mechanism to protect nature.

Can SAF be the path to net zero?

Marchant believes that Amex GBT, their customers and suppliers have to transition collectively towards a science-based target to actually achieve Net Zero by 2050. She insists that no single company can do it alone. In addition, the mission is time sensitive. As a result, more ambitious efforts are needed to push the envelope.

One of the best pathways to this future, according to Marchant, is through increasing SAF usage in airplanes. Even though SAF is three to six times more expensive than jet fuel today, and supply is severely constrained, for Marchant there’s possibly no other alternative. She says that SAF is an example of a “no regrets investment”. She believes that the deployment and commercialisation of the well-researched advanced SAF technologies will have positive unintended consequences in ways that we cannot envision today.

What gives Marchant the most hope is that from being a planet unconcerned about the climate crisis we have gradually grown more and more active and aware in tackling it. For example, it started with the European Union’s ReFuelEU Aviation initiative. The UK followed with their Jet Zero announcement. Most recently, the United States, through the Inflation Reduction Act, has enacted the biggest piece of climate legislation in the history of the world. In addition, there are 24 different policies supporting SAF in various countries around the world.

In fact, Marchant believes that at this point, the world has made a decision about sustainability and it doesn’t matter if the political winds change. A net zero future is just baked into regulation around the world.

“Time is not our friend here. And that means getting to work now, rolling up our sleeves, and scaling all the things that we want to do throughout our supply chain. Because the green industrial revolution actually requires the revolution part. We can’t hope to get there through business as usual.”

Our Take

Carbon offsetting is a market-based mechanism that allows corporations and individuals to neutralise their carbon footprint by investing in environmental projects that remove (or offset) an equivalent amount of carbon. Though a widely used tool, the efficacy of carbon offsets is very controversial.

Market-based solutions to climate change position markets as powerful and swift agents capable of meeting the twin objectives of economic development and ecological conservation. They work on the principle of commodification and tend to value Nature and all its functions in economic terms. This allows Nature to be framed as a “fungible” entity composed of interchangeable constituent units. We can continue to swap these units across Nature for as long as the sum total remains unchanged.

So, environmental damages (or losses) in one part of the world can be compensated by equivalent environmental gains in an entirely different region, to restore a balance. For example, through carbon offsetting, carbon emissions in one location can be balanced out by sequestration in another.

While offsetting seems like a great solution in principle, putting it into practice is not as straight-forward. It requires a complete economic and systemic restructuring, and new regulations and incentives. Moreover, with the underlying principle of ‘polluter pays’, offsets don’t encourage emissions reduction. Polluters can buy offsets and continue to potentially endlessly ravage the environment.

Another solution Marchant mentioned was SAF. With its Avelia platform, Amex GBT promises greater participation and to consequently spur growth. Contrast this with ZeroAvia CEO Val Miftakhov’s opinion that airlines’ over-reliance on SAF is ironically unsustainable. He believes there isn’t enough feedstock and that the costs of SAF production are too high to be feasible.

Ultimately, as Marchant herself agrees, promoting SAF supply will require regulatory support and concerted efforts across the aviation industry. Moving away from jet fuels requires incentives that can take quite a bit of time to produce results. It is a road that will reveal itself only when it is traversed.

Our Sustainability in the Air podcast is powered by SimpliFlying which has been helping build trust in travel for over a decade.

This season of the podcast is brought to you by CarbonClick, leaders in managing carbon offsetting programs for top global airlines.