US Election 2024: How a Trump win could reshape sustainable aviation

Guidance for companies and investors on what to expect.

Executive summary

The 2024 US presidential election, particularly a potential Trump victory, could significantly impact climate tech and sustainable aviation sectors.

While it might jeopardise green subsidies and risk $1 trillion in low-carbon investments, we remain optimistic about the future.

Many clean energy initiatives are rooted in traditionally conservative states, other states are doubling down on their support for green tech, and global opportunities are emerging.

To navigate these challenges, we advise companies and investors to engage with state-level policies, diversify geographically, focus on market-driven solutions that are not subsidy-dependent, and maintain a long-term perspective on the clean energy transition.

Introduction

As the 2024 US presidential election approaches, the possibility of a Trump victory – currently at 65% odds on betting markets – raises questions about the future of green initiatives, especially in transport and aviation.

The current Biden administration has implemented generous green subsidies through the Inflation Reduction Act (IRA). How might this landscape change if the more fossil-fuel-friendly Donald Trump returns to the White House?

Without making any political endorsements, this article offers guidance for companies and investors on what to expect.

The threat to green subsidies

While the Inflation Reduction Act is crucial to the current administration's climate policy, having significantly boosted the clean energy sector, most Trump insiders oppose clean energy or green subsidies in their current form. A few deny climate change outright, while others downplay its impact and/or disagree with the solutions used to combat it.

Generally, they believe that prioritising fossil fuels strengthens the US economy and benefits ordinary Americans, whereas focusing on clean energy does the opposite. One Trump environmental advisor called clean energy measures "apocalyptic green fantasies" that will "bankrupt us all."

Consequently, Bloomberg Intelligence reports that a Trump victory in November 2024 could jeopardise $369 billion of the $433 billion in IRA grants, loans, and tax incentives.

This uncertainty is already affecting the industry. For instance, Universal Hydrogen's recent closure was partly attributed to concerns about a potential Trump administration.

A Trump presidency could intensify the following challenges:

Sustainable Aviation Fuel (SAF) mandate: The chances of a Federal SAF mandate for US airlines would almost certainly diminish, potentially slowing cleaner fuel adoption.

Green hydrogen development: Removing tax credits could hinder the commercialisation of this technology, which currently costs 4-7 times more than grey hydrogen.

Investment uncertainty: Wood Mackenzie suggests a Trump victory could risk up to $1 trillion in projected low-carbon energy investments.

Emissions trajectory: One analysis indicates a second Trump term could increase US emissions by 4 billion tonnes by 2030, given the commitment to withdraw from the Paris Agreement

The resilience of clean energy initiatives

Despite these potential setbacks, it's worth remembering that many US clean energy initiatives are located in traditionally conservative or "red" states like Texas and Louisiana.

This geographic spread makes a complete dismantling of Biden's climate tech infrastructure unlikely. Congressional and state-level figures will resist losing jobs dependent on renewable energy projects.

Simultaneously, states like California – the world's fifth-largest economy – have begun "Trump-proofing" their clean energy programs.

Four areas of focus for investors

Even with a Trump win, several promising areas remain for climate tech and green aviation investors:

1. State-level initiatives

Investors should monitor states with strong green incentives like California, as these regions could become hubs for climate tech innovation and sustainable aviation development.

2. International opportunities

The climate tech landscape extends beyond US borders. Countries like Canada and Chile offer growing incentives for clean energy and sustainable aviation.

Canadian incentives include:

30% Investment Tax Credit for renewable technologies;

Clean Technology Investment Tax Credits for manufacturing equipment;

Up to 40% tax credits for green hydrogen projects.

Incentives in Chile include:

National Hydrogen Strategy aiming to lead in green hydrogen exports by 2040;

Goal to produce the cheapest green hydrogen globally (below $1.5/kg by 2030);

Ambitious targets for electrolysis capacity and green hydrogen production.

Both countries can produce some of the world's cheapest renewable energy, which is crucial for green hydrogen production.

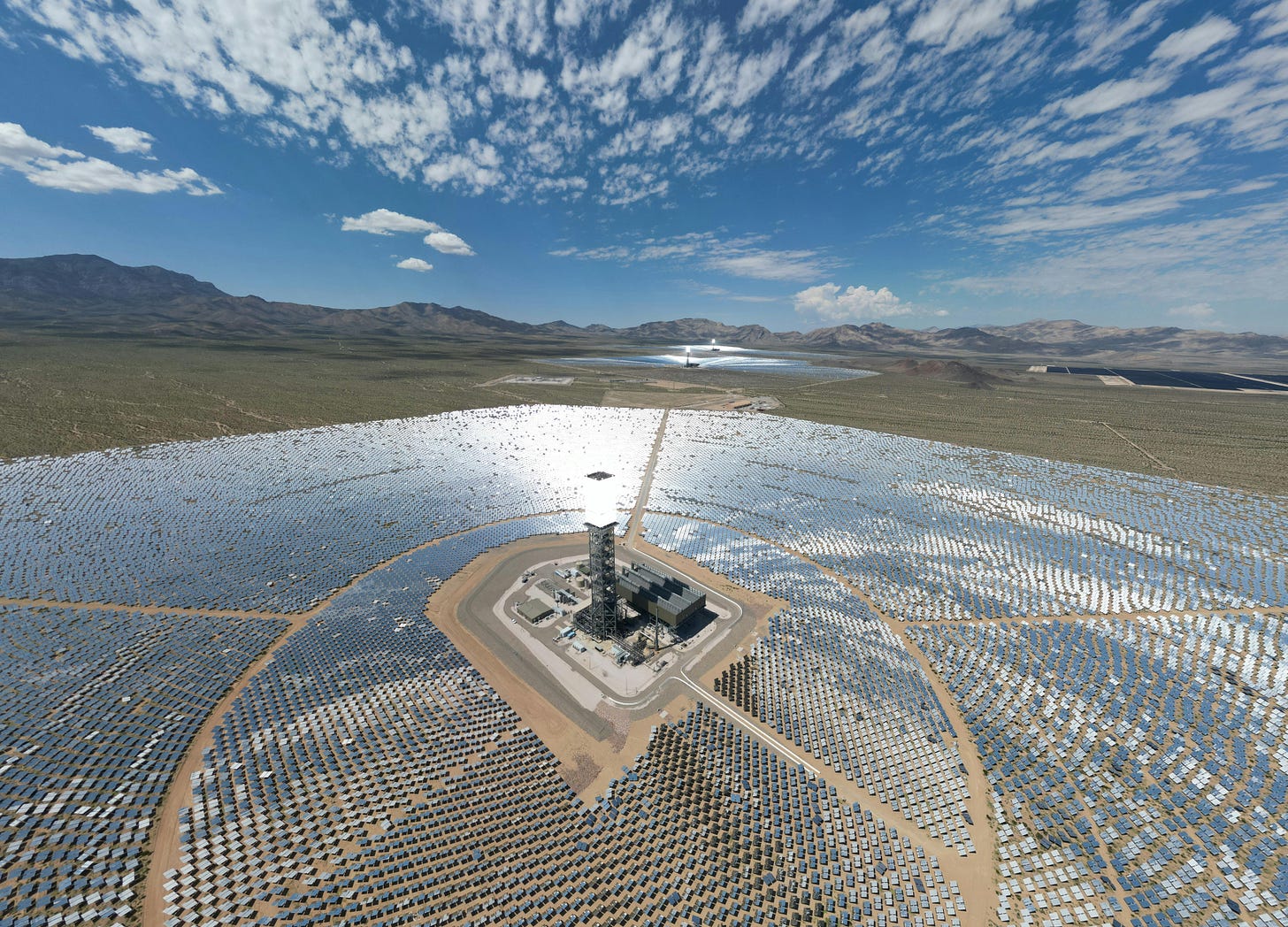

Chile has exceptional solar resources in the Atacama Desert, one of the driest and sunniest places on Earth. This allows for very cheap solar production. The country also has significant wind resources, especially in the southern regions.

Canada has massive potential for wind energy, especially off the coasts of Quebec and Newfoundland, where wind resources are strong and consistent. Low renewable energy costs are crucial – they account for over half the cost of green hydrogen production.

The EU and UK also have substantial mandates and regulations, offering stable markets for climate tech and sustainable aviation products.

3. A more global focus

A shift in US climate policy could also allow other regions, particularly Asia, to lead in sustainability efforts. Countries like China, India, Japan, and South Korea are investing heavily in clean energy technologies, which could accelerate their efforts and present opportunities for investors to diversify portfolios.

For example, China is currently building two-thirds of the world's utility-level wind and solar projects.

4. Beyond subsidies

Market-driven solutions are emerging as a safer bet in the US. To take just one example, retrofitting aircraft with battery electric technology offers benefits regardless of political climate:

Noise reduction: Electric aircraft are quieter, addressing community concerns near airports.

Lower operating costs: Electric propulsion systems typically have lower maintenance and fuel costs.

Extended aircraft life: Retrofitting can improve efficiency and extend operational lifespan.

Reduced subsidy dependency: As a market-driven solution, it's less vulnerable to policy changes. Battery development is progressing towards the 500 Wh/kg energy density target, making electric commercial flight more viable.

These advantages make battery electric retrofitting appealing for aviation companies seeking to improve sustainability while managing political risk.

Long-term trajectory

Despite short-term political uncertainties, the medium to long-term direction of climate tech and sustainable aviation remains clear.

As Shara Mohtadi of S2 Strategies noted on NPR, "The inevitability of the economy being completely run on clean energy in the next decade, two decades is there."

Factors contributing to this long-term trajectory include:

The decreasing costs of clean energy technologies, such as solar and wind power, which have become more affordable and accessible;

The increasing number of corporate commitments to reducing emissions and transitioning to sustainable practices;

The growing investments in clean energy projects across political divides indicate a broader societal shift towards prioritising sustainability;

Finally, the global momentum towards decarbonisation, supported by international agreements and public advocacy.

Conclusion

In conclusion, we advise businesses and investors to implement a comprehensive approach to navigate the evolving landscape of climate tech and sustainable aviation. This should include the following key elements:

Diversifying investments geographically to mitigate policy risks;

Focusing on market-driven solutions beyond subsidies, like battery electric aircraft retrofitting;

Engaging with state-level initiatives, especially in proactive states;

Monitoring international markets with stable, ambitious climate policies;

Maintaining a long-term perspective on decarbonisation trends.

By adopting a strategic, flexible approach, companies and investors can weather policy changes while capitalising on long-term opportunities in climate tech and sustainable aviation.