With Trump set to become the next US president, there is much anxiety about how his leadership style will impact global aviation. It's not the policies, but the unexpected nature of his executive orders concerning top airline leaders I've been in touch with.

Expect the unexpected

The last time Trump was leading the US, he campaigned on a platform to ban Muslims from the US. He then issued an in-flight electronics ban for airlines flying from the Middle East to the US. While most airlines suffered a significant drop in demand, airlines like Emirates provided Business Class passengers with laptops for in-flight use.

Nifty airlines took advantage of the bans with some viral guerrilla marketing campaigns. Does anyone remember the poems Royal Jordanian put out during Trump's first term? Or the brilliant video Aeromexico released when the wall on the Mexican border was all the rage? Even Turkish Airlines came up with a Super Bowl campaign that was noticed.

Just like last time, airline leaders must be on their feet to respond to unexpected requirements being imposed.

What does Trump 2.0 mean for sustainable aviation?

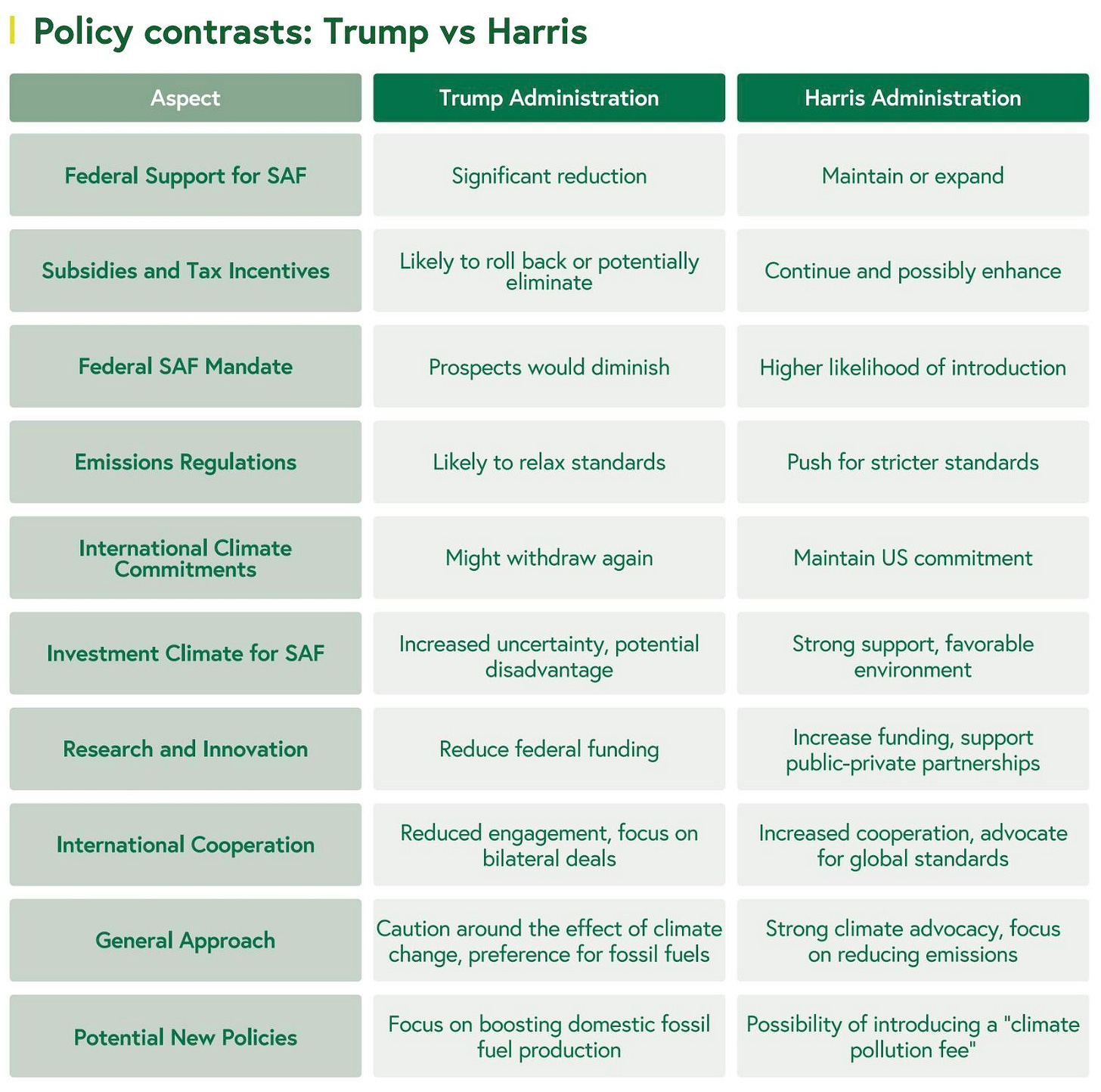

As we shared in a recent detailed analysis, under Trump's presidency, the industry could expect a significant reduction in federal support for SAF development. Trump's scepticism towards climate change measures and preference for fossil fuels suggests he might roll back or eliminate subsidies and tax incentives provided by the IRA. The prospects of a federal SAF mandate for US airlines would likely diminish, potentially slowing the adoption of cleaner fuels.

Trump's approach to emissions regulations would probably involve relaxing aviation industry standards. His previous withdrawal from the Paris Agreement indicates he might withdraw again from international climate commitments, focusing instead on boosting domestic fossil fuel production rather than reducing emissions.

Nonetheless, the US's medium—and long-term sustainability trajectories for US technologies and airlines appear secure. Overall, the current momentum should see the realisation of significant decarbonisation efforts over the next decade.

Rolling back IRA incentives will be hard

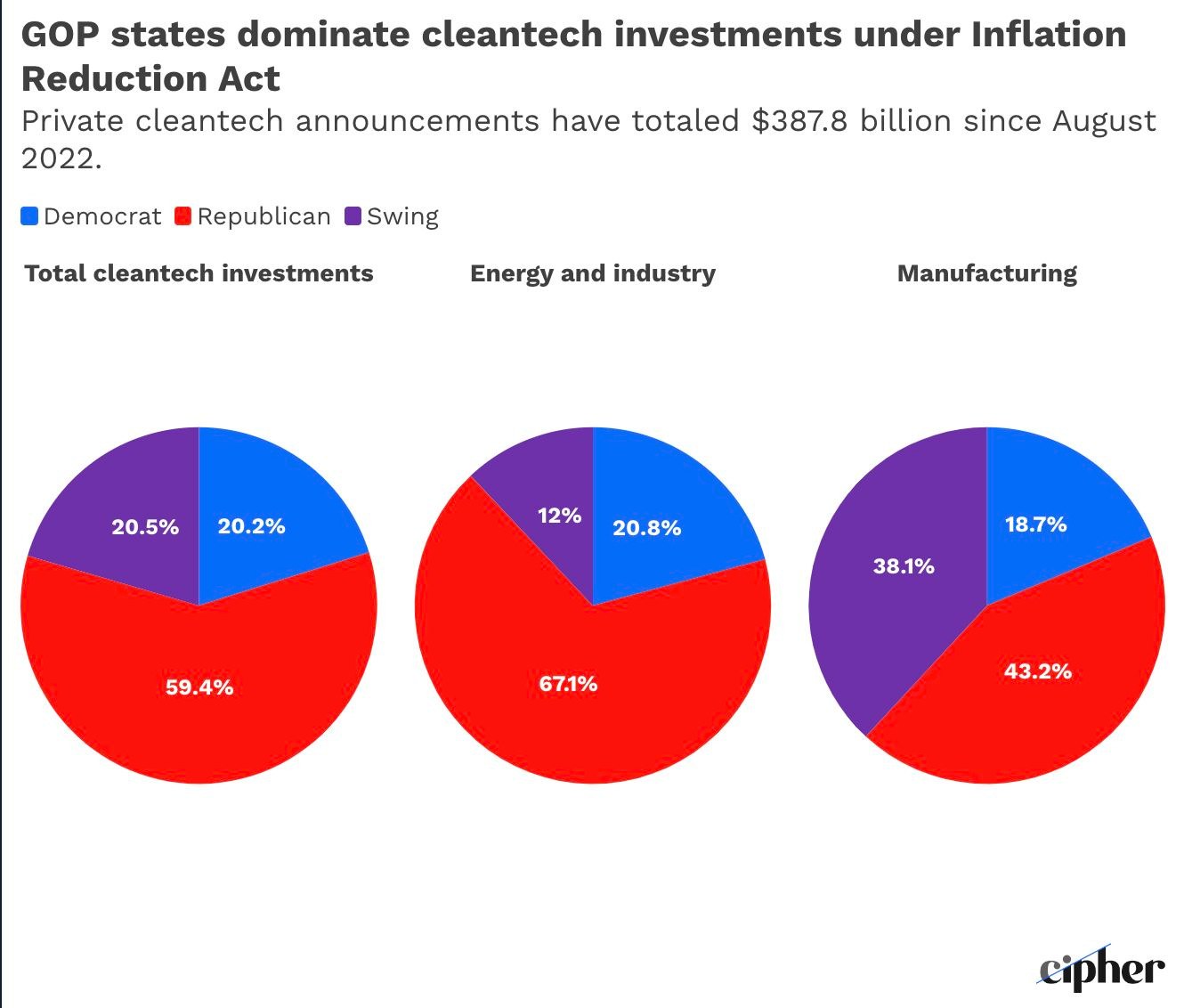

While no Republicans voted for the Inflation Reduction Act, it's the residents of red states who have benefitted the most from cleantech investments. These states have reaped over half of the $387.8 billion of announced investments in cleantech manufacturing and deployment since the IRA passed. This geographic spread makes a complete dismantling of Biden's climate tech infrastructure unlikely. Congressional and state-level figures will resist losing jobs dependent on renewable energy projects.

States will lead where the Federal government doesn't

California is already proposing to aggressively reshape its own climate policy, which will draw in further SAF supply and support growing demand. States will lead where the Federal Government will not. We will also likely see more states adopting LCFS-type policies in the next couple of years, either as a foil to a new administration or as part of a rising tide under a what could have been a Harris administration.

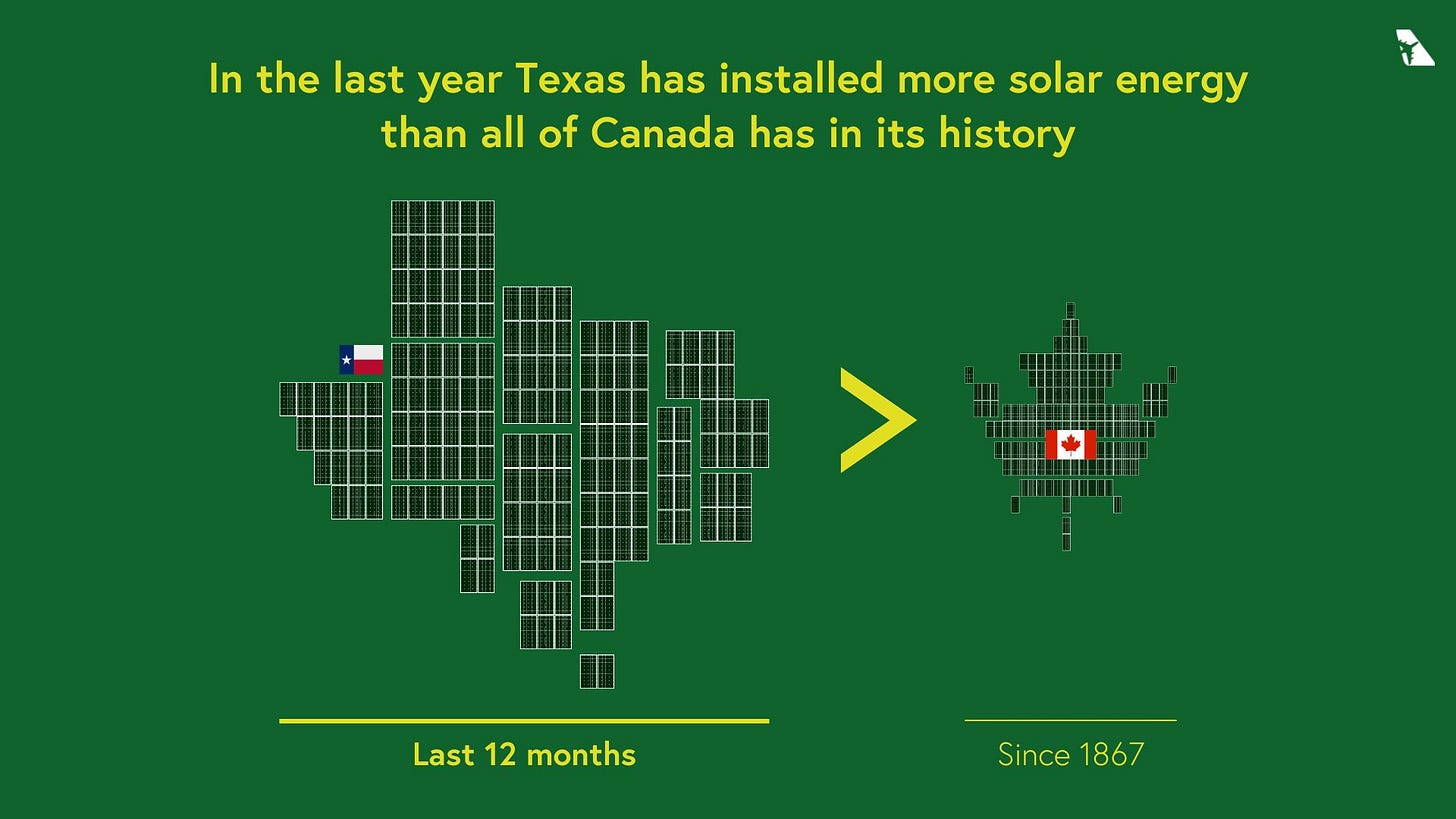

Individual states' policies will lead to technological progress that may show that clean energy can co-exist with traditional fossil fuels. A great example is Texas, which has passed California with the most power-generating capacity from solar projects in the US.

The state's utility-scale solar capacity reached 21.9 gigawatts in Q2 2024, moving ahead of California's 21.1 GW, according to the American Clean Power Association (ACP). That's one-fifth of the US total. And another 12 GW are under construction, more than the next five states combined, per ACP.

What does this show?

Renewable energy can grow in the backyard of big oil.

Renewables can scale if the environment and policy are aligned (like the IRA incentives).

It also demonstrates that building renewables doesn't have to be bound by political leanings.

International policies matter even more

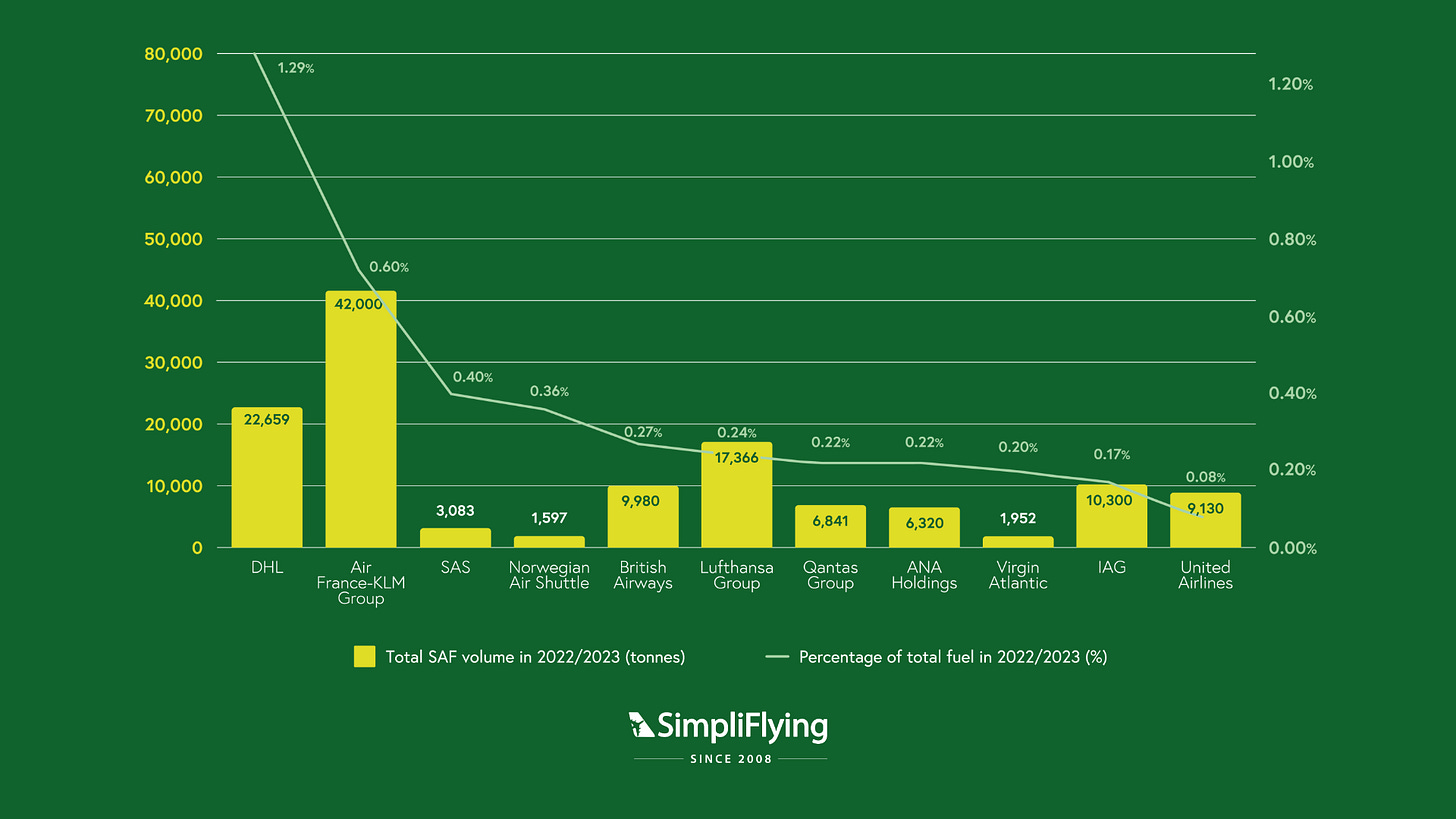

There has been much debate recently on the effectiveness of incentives in the US vs the European mandates in driving the adoption of sustainable policies in aviation.

A good case in point is SAF uptake. While a number of US airlines have signed SAF offtakes for the future, it is primarily the European carriers that are leading with SAF adoption today. This trend is likely to accentuate under Trump 2.0. The next four years will allow global regions to implement policies that drive action, not delay it - from Canada to Chile.

The US will still want its technology innovators to lead globally

On my podcast, Sustainability In The Air, Americans form the single largest nationality among guests. That's not a coincidence.

The US is leading the world in everything from battery technology to reducing the green premium on SAF today. American eVTOLs are set to take flight in the Middle East in the coming months, while European competitors flounder. While Trump 2.0 may be unpredictable and unexpected, we can all agree that the administration would want to promote American technology and keep its superiority intact.

Energy security is likely to become a larger driver of new technologies like eSAF rather than environmental sustainability. Startups like Air Company (also featured in our book) and JetZero have already benefited from the Department of Defense contracts, and we may see more technologies benefiting from them, too.

Conclusion

In conclusion, as mentioned in our pre-election analysis, we advise businesses and investors to implement a comprehensive approach to navigate the evolving landscape of climate tech and sustainable aviation. This should include the following key elements:

Diversifying investments geographically to mitigate policy risks;

Focusing on market-driven solutions beyond subsidies, like battery electric aircraft retrofitting;

Engaging with state-level initiatives, especially in proactive states;

Monitoring international markets with stable, ambitious climate policies;

Maintaining a long-term perspective on decarbonisation trends.

By adopting a strategic, flexible approach, companies and investors can weather policy changes while capitalising on long-term opportunities in climate tech and sustainable aviation. This will help dampen the impact of any unexpected policy changes during Trump 2.0.